Achievements

80+ Million Registered Users in 5 Years

Achieved one of the fastest adoption curves in the global fintech industry, onboarding millions of previously unbanked citizens.

Over $10 Billion Monthly Transaction Volume

A steadily growing figure, positioning Nagad as one of South Asia’s highest-volume fintech platforms.

Groundbreaking e-KYC & Instant Onboarding

Introduced paperless, real-time account setup—an industry first in the region—lowering entry costs and boosting financial inclusion.

Strategic Partnerships with Government & Postal Directorate

Strengthened credibility and aligned with national financial inclusion policies through collaborations with the central bank and postal authorities.

Robust, Scalable Infrastructure

Capable of handling up to 100,000 transactions per second, future-proofing Nagad for regional and global expansion.

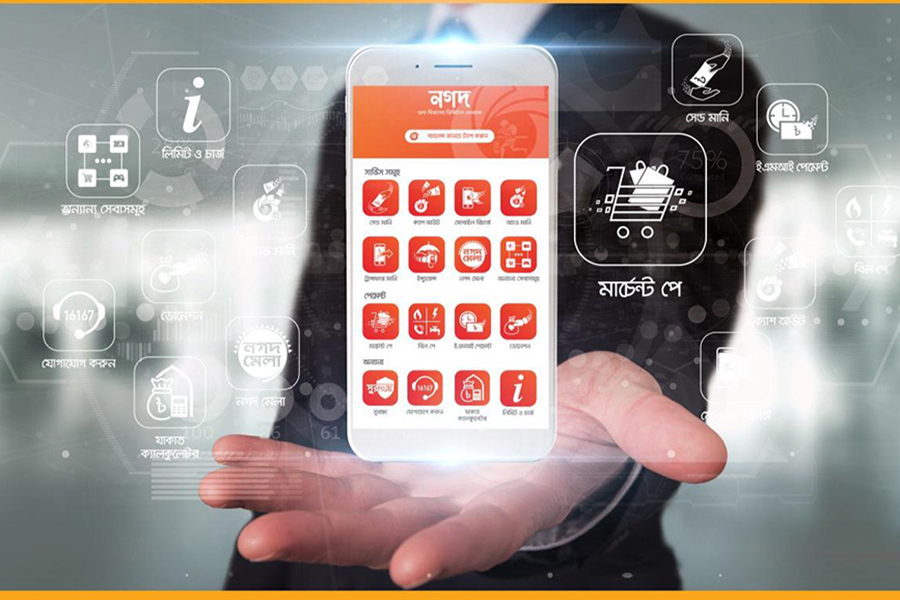

Beyond Payments: A Full Financial Ecosystem

- Embedded Savings & Insurance: Offering integrated services within the Nagad app to encourage long-term financial planning.

- Digital Loans: Accelerating microcredit opportunities through instant approvals and disbursements.

- Smart Remittance: Enabling faster and more cost-effective cross-border transactions for over 10 million overseas users.

Global Recognitions

Fintech Personality of the Year

Award Provider: Global Brands Magazine (UK)

Year: 2022

Honored for pioneering digital financial services that foster inclusion in emerging markets.

WITSA Global ICT Excellence Award – Malaysia

Award Provider: WITSA

Year: 2019

Applauded for groundbreaking mobile financial solutions that bolster national economic digitalization.

Digital Bangladesh Award 2020

Award Provider: Government of Bangladesh

Year: 2020

Recognized by the Prime Minister’s Office for significant contributions to the country’s digital economy.

Kotler Iconic Achiever Award

Award Provider: Kotler Impact and the World Marketing Summit

Year: 2023

Awarded For: outstanding contributions to digital innovation and social empowerment.

Top 50 Inclusive Fintech Leaders

Award Provider: Inclusive Fintech 50

Year: 2020

Awarded For: Selected among global leaders for championing fintech solutions that uplift underbanked communities.

Media Spotlights

Featured in prominent publications such as Bloomberg, ICE Business Times, CEO Insights India, The Daily Star, New Age Bangladesh, and showcased at events like the World Fintech Festival.

Innovations

Instant Digital KYC Verification

- Challenge: Long, paper-based bank account processes.

- Solution: e-KYC linked to national ID databases for instant onboarding, slashing operational costs and onboarding time.

Real-Time National ID Integration

- Challenge: Lack of smartphone access hindered digital adoption.

- Solution: Combined USSD (for feature phones) with a user-friendly smartphone app, drastically expanding reach in rural areas.

Zero-Cost Merchant QR Solutions

- Challenge: Costly POS systems for micro and small merchants.

- Solution: Simple QR-based payments with no equipment fees, digitizing 300,000+ SMEs.

AI-Driven Financial Literacy

- Challenge: Low literacy and limited understanding of digital finance.

- Solution: AI chatbots and SMS tools in multiple languages to educate and guide new users on savings, transfers, and investments.